Little Known Facts About How Will Filing Bankruptcy Affect My Small Business.

Our signature confidential session will aid determine the ideal Alternative to your business and In addition – it’s no cost!

In the event your business debts exceed your personal obligations, you will not want to meet the revenue requirements in the Chapter 7 usually means test (this rule relates to all folks filing for Chapter 7).

It’s necessary to start off rebuilding your credit score right away. The effects of bankruptcy with your credit rating will reduce eventually, and having proactive methods can speed up this process. Take into consideration credit history maintenance techniques and check with monetary advisors to obtain again on target.

It’s imperative that you establish your goals and long run options to your business in advance of filing. For example, Would you like a clean start out but will also want to carry on operating?

Exceptional way out to MCA loans! Thanks to Juan I received obvious, actionable assistance on running my MCA debt. Their knowledge and direction ended up a must have, helping me navigate a complex economic condition with self-assurance. Remarkably recommend!

These supplemental details permit our attorneys to achieve a further comprehension of the particulars of the circumstance

Within a sole proprietorship, you and your business are just one and precisely the same, legally speaking. This suggests your own belongings might be in danger In the event your business is in financial debt. Over the flip side, an LLC or Company provides a layer of defense, preserving your personal belongings individual from business debts.

In most cases, a business owner can get a better price tag for that business their website belongings and pay out a far more important share with the business credit card debt, leaving less financial debt for an owner to pay for as a result of a private promise.

It’s an financial commitment in the financial potential Read More Here and the future of your business. Have faith in us, pro steerage can make a world of distinction in the outcome of one's bankruptcy situation.

This "loophole" allows the filer read here to wipe out qualifying personal debt in Chapter 7 despite building a considerable income. Talk to using a educated click here to find out more bankruptcy lawyer professional in business bankruptcies.

Thankfully, small businesses can now use Chapter eleven, Subchapter V, a comparatively new bankruptcy reorganization that's much easier and less expensive as it's more like Chapter 13. To find out more about bankruptcy for your small business, see Small Business Bankruptcy.

Nolo was born in 1971 as a publisher of self-aid lawful guides. Guided from the motto “legislation for all,” our legal professional authors and editors have been describing the legislation to day to day individuals ever due to the fact. Find out more about our record and our editorial standards.

Under Chapter thirteen, a sole proprietor can file for private bankruptcy and petition the court to reorganize their debts. The real key point to recall is to be a sole proprietor, You must file for bankruptcy underneath your personal title, not the business’s identify.

So you may be able to dissolve your business entity below your state's regulations, buy the resources in see it here the trade from your business, and reap the benefits of this exemption in your own bankruptcy.

Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Burke Ramsey Then & Now!

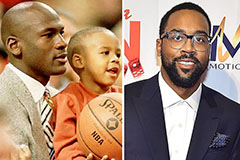

Burke Ramsey Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now!